This will be my first, and probably last, non-photography related blog. I’m doing this because I’m frankly a little scared. I’m sacred about what is going to happen in the coming months and years, post pandemic. Now, most of you reading this don’t know me personally, but I want you to understand that I consider myself to be kind, socially-minded and ecologically conscious. Further, I do everything I can to avoid living my life in fear. During the pandemic my wife, young family and I used the time to concentrate on the beauty of nature and our surroundings, and we chose to focus on nurturing each other, rather than be fearful of what was going on outside of our control. As a family unit, it was the best year of our collective lives to date.

Despite this aversion to fear, what specifically am I scared of? In a word, hyperinflation. I am not and never have been strongly motivated by money. It’s just a tool to allow us to buy a loaf of bread without bartering. However, I think there is a good chance the price of that loaf will soon spiral out of control, and I’m far from alone with this belief. Why do I think this may happen? From our old pal Wikipedia, hyperinflation “…occurs when there is a continuing (and often accelerating) rapid increase in the amount of money that is not supported by a corresponding growth in the output of goods and services.”

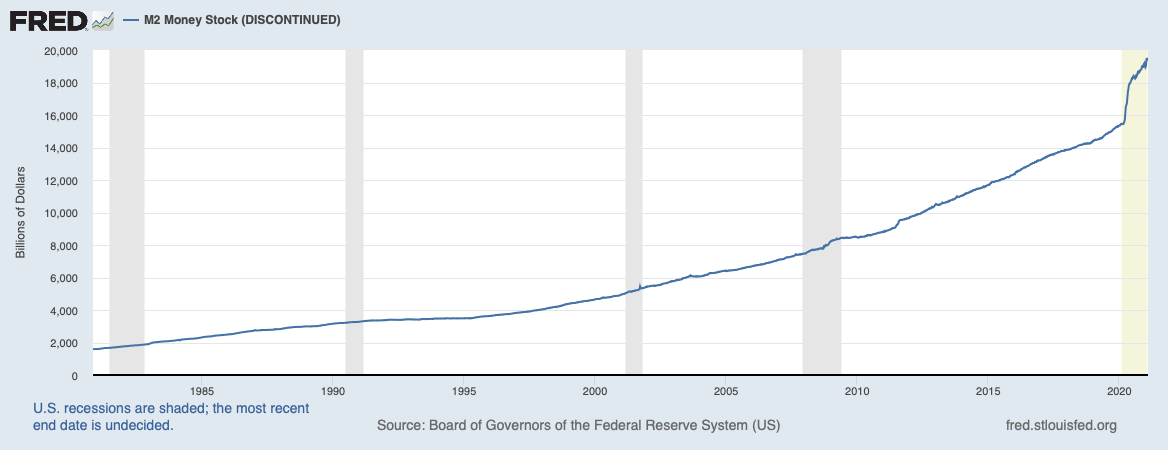

Here is a graph of the money supply of the dollar. This is important to us all as the dollar is the global reserve currency of the World, and the Pound, the Euro etc. are all being ‘over-printed' as well, a process innocuously called Quantitative Easing. This is to relief-fund the pandemic whilst simultaneously making the value of that increasing debt to be worth less. Of course it also means that your unit of currency buys less than it did a year ago. Inflation has always been built in to our current economic system, just never at these extreme levels.

On then to the second part of hyperinflation: low growth in the output of goods. You don’t need me to tell you what’s happening around you. The closure of shops, restaurants, hotels and so on, isn’t exactly providing a fertile ground upon which to stimulate the economy. Many businesses have either already folded or are at breaking-point, so the very real possibility of mass-unemployment looms. Without those tax revenues coming in, how can governments continue to support their populace? People need to eat after all. The option they seem to have plumped for is to print more money and extend furlough in the UK, or dish out stimulus cheques in the US. Its a vicious positive-feedback loop.

This is where Bitcoin and other cryptocurrencies offer a potential lifeboat to this situation. I’ve near-enough locked myself in a room for the last few months gathering as much information as I can, and the aim of this blog is to distil and share with you what I’ve found. If you didn’t get a chance to read my last blog (where I explained how this crypto currency journey all started for me), I’ll regurgitate and tweak some of the text from there.

There will only ever be 21 million BTC minted with most of them already in circulation (18M). It simply cannot be inflated, unlike any other store of value, such as gold. Bitcoin has been the best performing asset over the last decade, and despite the volatility, has given investors an average of 200% compounded returns every year. Compare that with your bank account returns of 0.01%.

The underlying tech at the core of Bitcoin is called the blockchain. The blockchain is a decentralised (i.e not owned by one person or company) ledger of transactions that is maintained by a network of computers around the world. The most important aspect of the blockchain is that it is irrefutable and unchangeable, in other words it can be ultimately trusted. As we know, trust can be in limited supply these days.

To put it bluntly, blockchain technology is going to change the World, in the same way that the internet did in the 90s. It will likely form the base layer of an upgraded internet, as discussed here. The tech will revolutionise everything, from authenticating ownership of property, music and art to improving the quality of your YouTube videos. It will even provide a solution to eradicating fake news and deep-fake videos. With the different protocols exploding like the Dot-com era, there will be 1000s of use-cases that haven’t been dreamt of yet. We will probably be voting on the blockchain in a future election, which would reveal the incontestable results instantaneously. Sorry ‘bout that Mr Trump.

Zoltan knows…

Despite the huge potential we have at our disposal, there is A LOT of what is called FUD (fear, uncertainty and doubt) surrounding the space. But ask yourself why? Why are there calls that Bitcoin is a ‘scam’? Or that it ‘has no real value’. The Pound, Dollar, Euro etc (collectively called fiat currencies) have no intrinsic value either. Currencies used to be backed by gold reserves, but Nixon put an end to that in the 70s. That fiat can be printed ad infinitum is the biggest scam of them all. If you want to label something a Ponzi scheme, look no further than fiat, the inflationary racket that helps keep you and I ‘poor’. We get wage increases below the rate of that inflation, and are encouraged to take on debt, but because we’re charged interest on subsequent purchases, this makes buying those things more expensive. We’re being fleeced from both sizes.

Banks hate Bitcoin as its decentralised nature is a threat to their very existence. But for the first time, every day more and more banks, and financial behemoths such as Paypal, Visa and MasterCard are getting into crypto… because they have to be, or be left behind. If you look past all the FUD, and concentrate on where the big money is flowing, you’ll see the mega rich understand that the fiat system has been milked dry, so they’re moving some, if not all of their wealth into Bitcoin. Citibank have just released a report that state it is at the tipping point of going mainstream, and it may well be how international trade is settled in the near future. The times, they are a-changing.

So there must be a downside, right? The only stain on the playbook that I can see is the amount of power consumption that it uses to maintain the blockchain ledger. I consider us to be a green minded family and I want to hand over my little corner of this beautiful planet to my children in the same condition that I was born into. What’s more, there are some eye-watering figures associated with Bitcoin power consumption, but when delving deeper than the mainstream media headlines, you will find that it’s a more nuanced picture than first appears. Life is so rarely black and white, despite the polarisation of opinions in vogue today, and to write off Bitcoin because it uses a lot of power is an opinion I find somewhat hypocritical. The internet is estimated to use 3-6% of the Worlds power. The fact you’re reading this, means that you’re complicit in this excruciating energy expenditure. Given that Bitcoin and the blockchain will likely form the backbone of an upgraded internet, this gives it some context that is, for me at least, morally palatable. Just the electronic devices left on standby in America alone, uses about twice the power of Bitcoin mining in the same timeframe. How’s that for a shocking headline?

Power stations need to overproduce power otherwise we’d be getting power cuts on a daily basis. Just like my dog, electricity doesn’t travel well, so in an effort to get the cheapest current around, miners commonly position themselves close to power stations in order to siphon off any excess power that would otherwise be wasted. In many cases, the Bitcoin mining set-ups use renewable energy sources (up to 74% of mining) as it’s often cheaper to produce than fossil fuels. A possible silver lining is that there is a cash-rich incentive to improve the adoption of renewables, which has, and should continue to accelerate innovation in the field. It’s worth mentioning that Greenpeace UK have been accepting BTC donations since 2014, and when questioned about Bitcoin, their head of IT, Andrew Hatton, stated the larger issue at hand is that “we’re largely powering 21st-century technology with 19th-century energy sources.”

So, if you think there’s any validity to my beliefs and concerns, I’ll outline a few more thoughts and links to resources to help you get started. If you still think Bitcoin should be renamed Bitcon, or that you think our economy will snap back to normal service without a bump in the road, then I thank you for reading this far! Sorry if you feel I wasted your time.

If you’re still here and want to bag some Bitcoin, you’ll first need to download a crypto wallet. There are hundreds out there, and Coinbase is the largest, I believe. I personally use the Crypto.com app as you buy the coins at market price and it’s a super simple app to use. I’ll state now, these are all my opinions, I haven’t been paid to recommend any of this, its just what I use… and I am not a financial advisor and none of this is financial advice. Can’t sue me now, so there!

Everyday is a lottery

Once we’d invested our ‘rainy day fund’ into crypto (which has tripled in value in 3 months), we now use a method called ‘dollar cost averaging’. Basically, if you have £50 or £100 left over at the end of the month, just invest it rather than buying another piece of crap you don’t need. At the time of writing, £100 would get you 0.0025 BTC. It doesn’t sound like a lot, but 1 BTC can be divided into 100 million Satoshis, its smallest unit of the currency. If you re-frame your £100 purchase as 250 000 Satoshis, it might make you feel a little better. If hyperinflation kicks in, those 250 000 Satoshis are soon going to look like a very wise investment indeed.

It’s important to understand that the ride isn’t actually as easy as you might think. With the volatility of the infant industry, you are put through he psychological wringer. Your funds can drop by 20, 30 even 40% overnight, although this volatility is reducing as the market matures, and with it, so are the returns. You’ll need strong hands and ignore the instinctive urge to sell when the price drops… in fact, when others are panicking, you’ll have to be more logical than Spock as that’s the best time to buy. Conversely, ignore the emotional urge to buy when the price is rocketing up by $1000s per day and ‘buy the dip’. Most importantly, only ever invest what you can afford to lose, as there will likely be a crash in prices at some point in late 2021 or early 2022. This is because the crypto price waves in cycles… I’ll link to some resources below that explain this further. My personal belief is that we may see a big drop when (if) BTC hits $100K as it will be a target for a lot of people and they’ll take profit around that point. I also think there will be a second higher peak in the weeks and months following that, but, as my crystal ball is broken at the moment, this is just one mans opinion!

I apologise if all this sounds like one big sales pitch for cryptocurrencies, but it angers me to see all the uninformed opinions being repeated in parrot fashion without people having the first idea what they’re commenting about. The world economy is in a very fragile state indeed and I feel compelled to stick my neck on the line for this one. I understand that my business may be damaged by expressing these views, but I implore you to take this seriously, do some proper research (which probably means avoiding the hysteria of the mainstream media) and don’t automatically right off BTC and blockchain technology ‘because it uses a lot of power’. In recent years, we as a populace have a worrying tendency to regard things as black and white, them and us, but in truth, life is an infinite shade of grey. Maybe I’m mad, and hopefully I’m wrong, but if there’s a chance that I am right, then I believe investing a little in Bitcoin or other cryptocurrencies is an insurance policy against decades of irresponsible government policy.

Please share if you feel that your friends and family need to see this information.

Resources:

This is the most simple explanation of the Bitcoin mining and the blockchain that I have found.

This chap could well sell you your next used car, but here he explains what you need to do to buy crypto.

Ben Cowen is the person whose opinion I trust most in crypto. His analysis is based on maths, probability and is a much needed voice of pragmatism in the space. This collaboration Ben posted recently is an excellent explanation on the cyclical nature of Bitcoin and how to manage your crypto investments.

TMI is another honest source who brings you the news as it happens, but is peppered with his extensive knowledge, analysis and humour.

If you are still unsure of the ethics of cryptocurrencies, here is a piece on how they could help African nations and their citizens claw their way out of poverty.

Peace and Love to you all,

Andy